As a financial advisor, time is your most valuable asset. Between managing client relationships, ensuring compliance, and keeping up with market trends, it’s easy to feel stretched thin. That’s where automation comes in. By incorporating automated tools and processes into your practice, you can save time, reduce errors, and focus on what truly matters: delivering exceptional service to your clients.

The Benefits of Automation for Financial Advisors

1. Increased Efficiency

Manual tasks like data entry, appointment scheduling, and follow-up emails can consume hours of your workday. Automation tools handle these repetitive tasks seamlessly, allowing you to allocate your time to more strategic activities, such as portfolio management or client acquisition.

2. Enhanced Client Experience

Automated workflows enable timely communication and personalized interactions. For example, you can set up automated email sequences to send birthday greetings, portfolio updates, or market insights tailored to each client’s preferences.

3. Improved Compliance

Maintaining regulatory compliance can be overwhelming. Automation can help by tracking documentation, flagging potential issues, and ensuring deadlines are met, reducing the risk of human error.

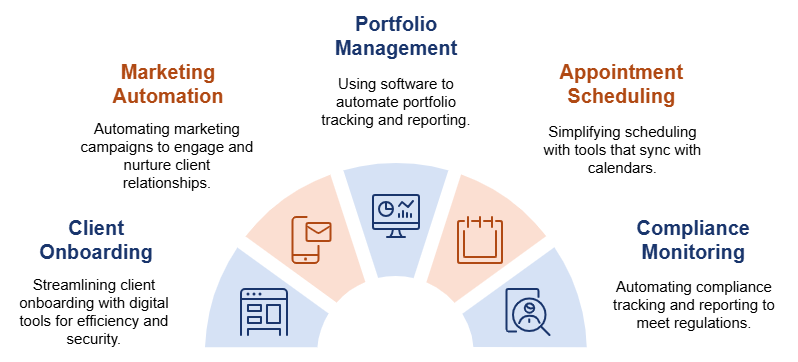

The Key Areas to Automate in Your Practice

1. Client Onboarding

Streamline the onboarding process with digital forms and automated workflows that collect, organize, and securely store client information. Tools like DocuSign and Redtail can expedite document handling and data entry.

2. Marketing and Lead Nurturing

Automate email marketing campaigns to nurture prospects and keep clients engaged. Platforms like Constant Contact allow you to segment your audience and deliver content based on their interests and needs.

3. Portfolio Management

Use portfolio management software like Black Diamond to automate performance tracking, rebalancing, and reporting. These tools can generate insights and deliver them to clients in an easy-to-understand format.

4. Appointment Scheduling

Eliminate the back-and-forth of scheduling with tools like OnceHub. These platforms sync with your calendar, allowing clients to book meetings at their convenience.

5. Compliance Monitoring

Leverage compliance automation tools to track regulations, monitor activities, and generate necessary reports. Software like RCI simplifies compliance management while ensuring you meet industry standards.

How to Get Started with Automation

1. Assess Your Current Processes

Identify time-consuming tasks that could be automated. Consider areas where mistakes are common or where efficiency could be improved.

2. Choose the Right Tools

Research tools that align with your practice’s needs and integrate well with your existing systems. Start with one or two solutions and expand as you become more comfortable with automation. Check out our preferred tech stack to discover trusted vendors that we have established relationships with.

3. Train Your Team

Ensure your team understands how to use the new tools effectively. Provide training sessions and encourage open communication to address any concerns or challenges.

4. Monitor and Adjust

Track the impact of automation on your practice’s efficiency and client satisfaction. Adjust your processes as needed to maximize benefits.

Looking Ahead

Automation is not about replacing human interaction; it’s about enhancing it. By automating routine tasks, you free up time to build deeper relationships with your clients and focus on strategic growth. In an increasingly competitive market, leveraging automation can give you the edge you need to stay ahead. Start small, embrace the change, and watch your practice thrive in the age of automation.