Navigating compliance is a complex and ever-evolving aspect of running a financial advisory business. As an independent advisor, your challenge is even greater, as you juggle regulatory requirements alongside managing client relationships and growing your practice. At Independent Advisor Alliance (IAA), we understand the pressures compliance imposes and have built solutions to address the most common challenges you face.

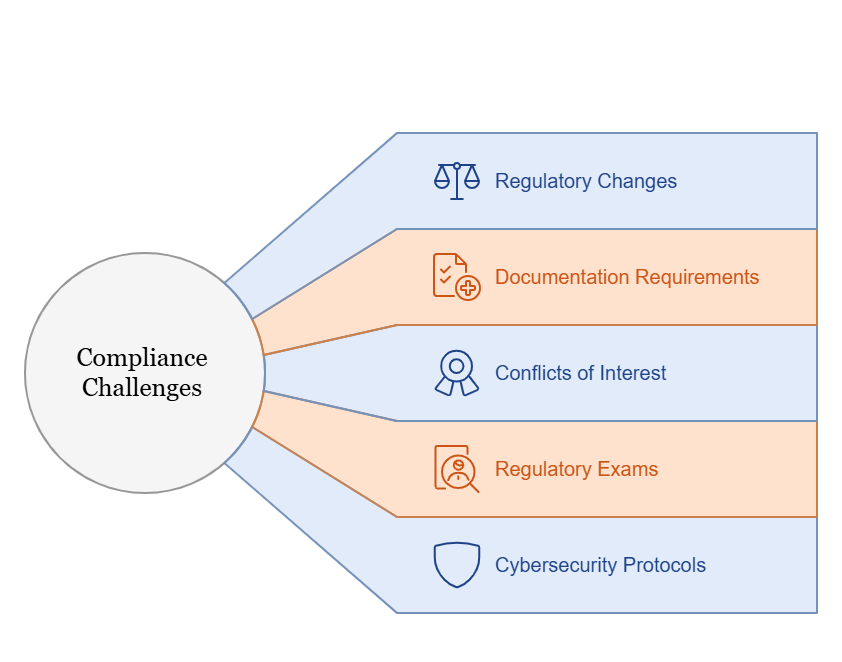

Here are the top five compliance challenges you encounter and how IAA empowers you to overcome them:

1. Keeping Up with Regulatory Changes

The financial services industry is constantly evolving, with regulators regularly introducing new rules or amending existing ones. It can often be overwhelming to stay informed and ensure compliance without dedicated resources.

How IAA Helps:

IAA provides ongoing regulatory updates, insights, and training tailored for you. Our team of compliance experts monitors changes from entities like the SEC and FINRA and distills key takeaways into actionable guidance. You benefit from proactive updates, ensuring compliance without sacrificing time spent with clients.

2. Managing Increased Documentation Requirements

You must maintain meticulous records of client communications, financial transactions, and investment decisions. The volume of documentation required for audits and examinations can be daunting, particularly for smaller practices.

How IAA Helps:

IAA leverages robust technology solutions to streamline documentation. From automated archiving of client communications to tools that simplify record retention, we ensure you can meet regulatory requirements with minimal hassle. We also provide hands-on assistance during audits to ensure a smooth process.

3. Avoiding Conflicts of Interest

Conflicts of interest can arise in various aspects of financial advising, such as fee structures, product recommendations, or compensation agreements. Ensuring full transparency is crucial to building trust and avoiding compliance breaches.

How IAA Helps:

IAA equips you with resources to maintain transparency and prioritize clients’ best interests. Our compliance team reviews marketing materials, fee disclosures, and client agreements to help you identify and eliminate potential conflicts.

4. Preparing for Regulatory Exams

Regulatory examinations can be time-consuming and stressful, with the risk of penalties for non-compliance. You can often feel underprepared to handle the detailed scrutiny of your practice.

How IAA Helps:

IAA offers comprehensive exam preparedness support. From mock audits to tailored guidance during an actual review, our compliance team works side-by-side with you to ensure all documentation and practices meet regulatory expectations. This support drastically reduces the stress of examinations while increasing your confidence.

5. Implementing Cybersecurity Protocols

With the rise of cyber threats, maintaining robust data protection measures has become a top priority for regulators. However, the resources to implement and manage comprehensive cybersecurity systems are often lacking.

How IAA Helps:

Through our partnership with We Handle Tech: 4 Advisors, IAA equips you with top-tier cybersecurity tools and protocols. They assist with implementing secure platforms, performing risk assessments, and ensuring you meet federal and state cybersecurity guidelines, keeping both client data and your reputations safe.

Partnering with IAA for Peace of Mind

At IAA, our goal is to relieve the compliance burden so you can focus on what you do best: serving your clients. By providing tools, expertise, and proactive support, we help you not only stay compliant but also thrive in an increasingly regulated environment.

Are you ready to take the stress out of compliance? Partner with Independent Advisor Alliance and experience the difference. Contact us today to learn more about how we can support your practice.