As your financial practice grows, so does the complexity of managing client relationships, communication, compliance, and operations. That’s where a Customer Relationship Management (CRM) system comes in. But with so many options on the market, how do you choose the right CRM for your financial practice?

Here’s a guide to help you navigate the decision-making process and find a solution that aligns with your business goals, team workflow, and client experience.

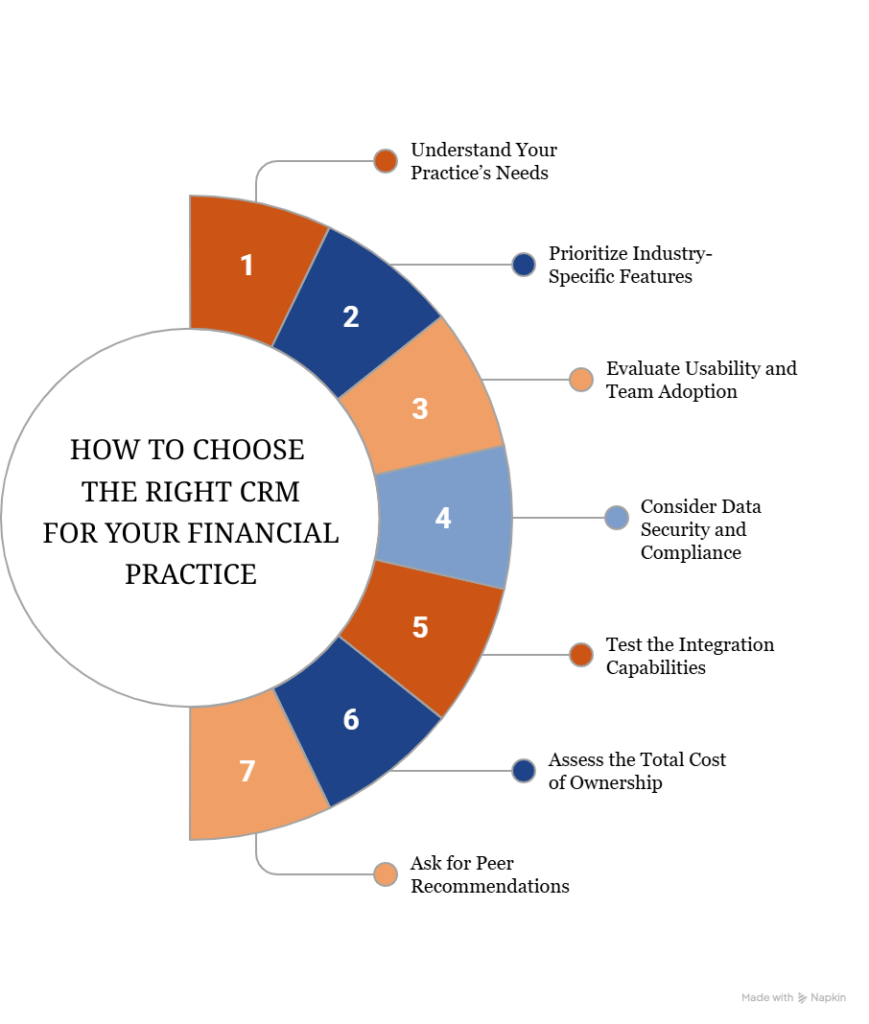

1. Understand Your Practice’s Needs

Start by identifying what you need from a CRM. Consider:

Team collaboration capabilities: Will multiple people in your practice use the CRM? Look for features that support a collaborative environment—like the ability to assign tasks, share workflows, and track progress across team members easily.

Client segmentation: Do you need to group clients by assets, life stage, or service level?

Workflow automation: Are you looking to streamline onboarding, reviews, or follow-ups?

Integration: Does your CRM need to sync with your financial planning tools, custodian platform, or marketing software?

Compliance: Are audit trails, activity logs, and secure data storage non-negotiables?

It’s also important to understand that your CRM can (and should) do much more than store contact information. When set up properly and used consistently, your CRM becomes a powerful tool for identifying business opportunities—through task tracking, pipeline management, and custom reporting that helps surface sales potential across your book of business.

Write down your must-haves versus nice-to-haves to guide your search.

2. Prioritize Industry-Specific Features

Generic CRMs can get the job done, but financial advisors often benefit from industry-specific platforms. Look for tools that offer:

- Built-in compliance support

- Financial planning integrations (e.g., eMoney, MoneyGuidePro)

- Performance reporting compatibility

- Client communication tracking (emails, calls, meetings)

A CRM designed for financial advisors will save you from costly workarounds.

3. Evaluate Usability and Team Adoption

A powerful CRM is useless if your team won’t use it. Consider:

- User interface: Is it intuitive and clean?

- Training and support: Will the vendor help onboard your team?

- Customizability: Can you tailor dashboards, pipelines, and tasks to your process?

- Mobile access: Can you manage relationships on the go?

Look for a CRM that fits naturally into your day-to-day operations.

4. Consider Data Security and Compliance

As part of your fiduciary duties, safeguarding client information is non-negotiable. Ensure the CRM has:

- SOC 2 or ISO 27001 certification

- Data encryption at rest and in transit

- Role-based access controls

- Secure backup and recovery systems

Ask vendors about their security protocols and how they help you stay audit-ready.

5. Test the Integration Capabilities

Your CRM shouldn’t operate in a silo. Evaluate how well it integrates with:

- Financial planning software

- Portfolio management systems

- Email marketing platforms

- Calendars and scheduling tools

- Document storage (e.g., SharePoint, Google Drive)

A well-connected CRM centralizes your tech stack, giving you a 360-degree view of your clients.

6. Assess Total Cost of Ownership

Look beyond the monthly subscription. Consider:

- Implementation fees

- Training costs

- Custom development or consultant help

- Add-on features or user limits

A lower upfront price might mean higher costs later if it doesn’t scale with your business.

7. Ask for Peer Recommendations

Talk to other advisors—especially those with similar business models or client bases. Find out:

- What CRM they’re using

- What challenges they’ve encountered

- How responsive the vendor is

- Whether they’d make the same choice again

Peer feedback is often more valuable than a polished sales demo. IAA’s LinkedIn Community Forum is a great place to gain recommendations from advisors within our partner network.

Final Thoughts

Choosing the right CRM is one of the most important tech decisions you’ll make for your financial practice. The right platform will save you time, enhance the client experience, and help your team operate at peak efficiency.

Need help choosing a CRM? Schedule a call with our Director of Advisor Technology, Lauren Grames.