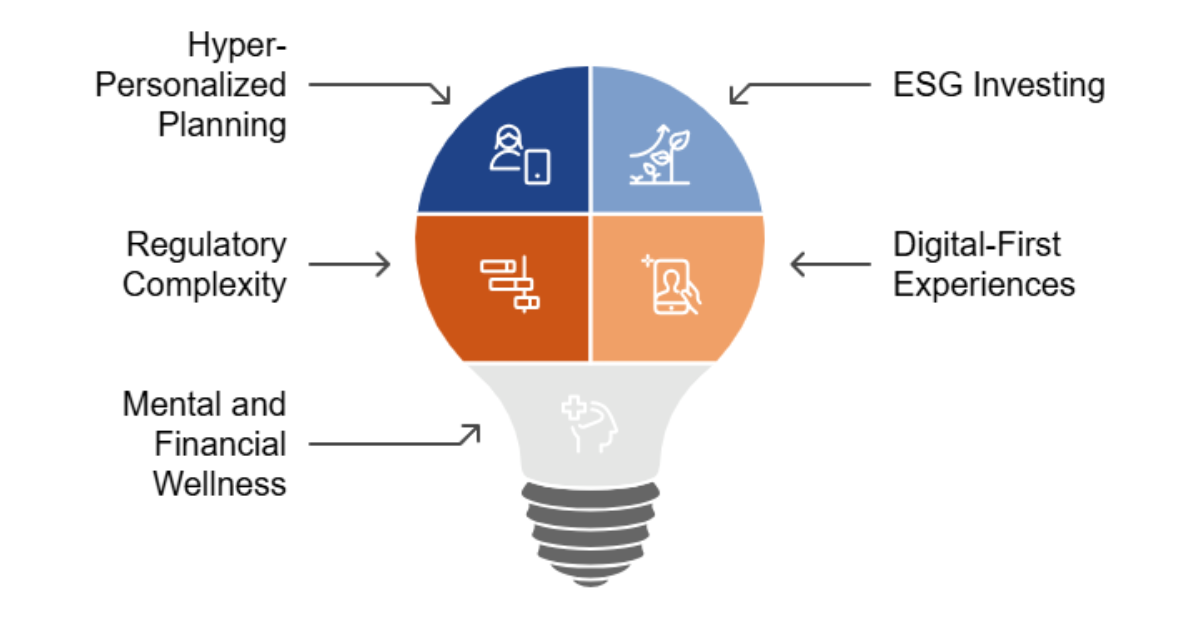

Technology, regulatory shifts, and changing client expectations are shaping the way advisors operate. To stay ahead in a financial advisory landscape that is continuously evolving, it’s essential to not just be aware of the trends but to proactively adapt. Here are five key trends every financial advisor needs to keep an eye on in 2025.

1. The Rise of Hyper-Personalized Financial Planning

Today’s clients expect a financial strategy that goes beyond generic advice. Advancements in data analytics and artificial intelligence are making hyper-personalized financial planning a reality. Advisors can now leverage tools that analyze spending habits, lifestyle goals, and risk tolerance to create tailored plans for each client. Those who embrace these tools will not only meet expectations but also build deeper client trust.

Take Action: Incorporate AI-driven platforms to provide customized insights. Explore client onboarding processes that collect detailed personal and financial data to refine strategies.

2. Increased Integration of ESG Investing

Environmental, Social, and Governance (ESG) investing is no longer a niche. With younger investors—especially Millennials and Gen Z—prioritizing sustainability, ESG portfolios are seeing unprecedented demand. Advisors who ignore ESG opportunities risk alienating a growing client base.

Take Action: Offer ESG-focused portfolio options and educate yourself on how these investments align with long-term financial goals. Partner with ESG-centric funds or develop in-house expertise to meet client demand.

3. Navigating Regulatory Compliance

Regulatory changes are a constant in the financial sector, but 2025 is poised to bring some significant shifts. From enhanced fiduciary standards to updated data privacy regulations, staying compliant will require vigilance and adaptability.

Take Action: Stay ahead by investing in compliance management software. Join industry groups or subscribe to regulatory newsletters to ensure you’re aware of changes as they happen. Our in-house compliance team provides monthly calls to ensure our partners are always aware of regulatory requirements.

4. A Growing Focus on Digital-First Experiences

Clients want convenience, and digital-first solutions are no longer optional. From virtual meetings to seamless online portals for managing finances, a robust digital presence is key to staying competitive. Gen Z and Millennial clients, in particular, gravitate toward advisors who meet them where they are—on their devices.

Take Action: Audit your tech stack to ensure you’re offering top-notch digital experiences. Enhance your website, implement secure online communication tools, and consider offering app-based services for easier client access.

5. Prioritizing Mental and Financial Wellness

Holistic advising, which merges financial health with mental well-being, is gaining traction. Economic uncertainty has heightened awareness of the link between financial stress and mental health, creating opportunities for advisors to play a more supportive role in their clients’ lives.

Take Action: Offer resources and workshops that address both financial literacy and mental well-being. Collaborate with mental health professionals or develop partnerships with wellness platforms to provide added value.

2025 presents a wealth of opportunities for financial advisors who are prepared to adapt to new trends. The key is to act now—your clients and your business’ success depend on it.

Our Forward-Thinking Approach

At IAA, we’re committed to innovation. We keep a pulse on industry news and leverage the latest technology to stay ahead of the curve. By staying current and anticipating future changes, we empower advisors to navigate evolving landscapes with confidence and agility. Schedule a call with our team to learn more about our forward-thinking approach.